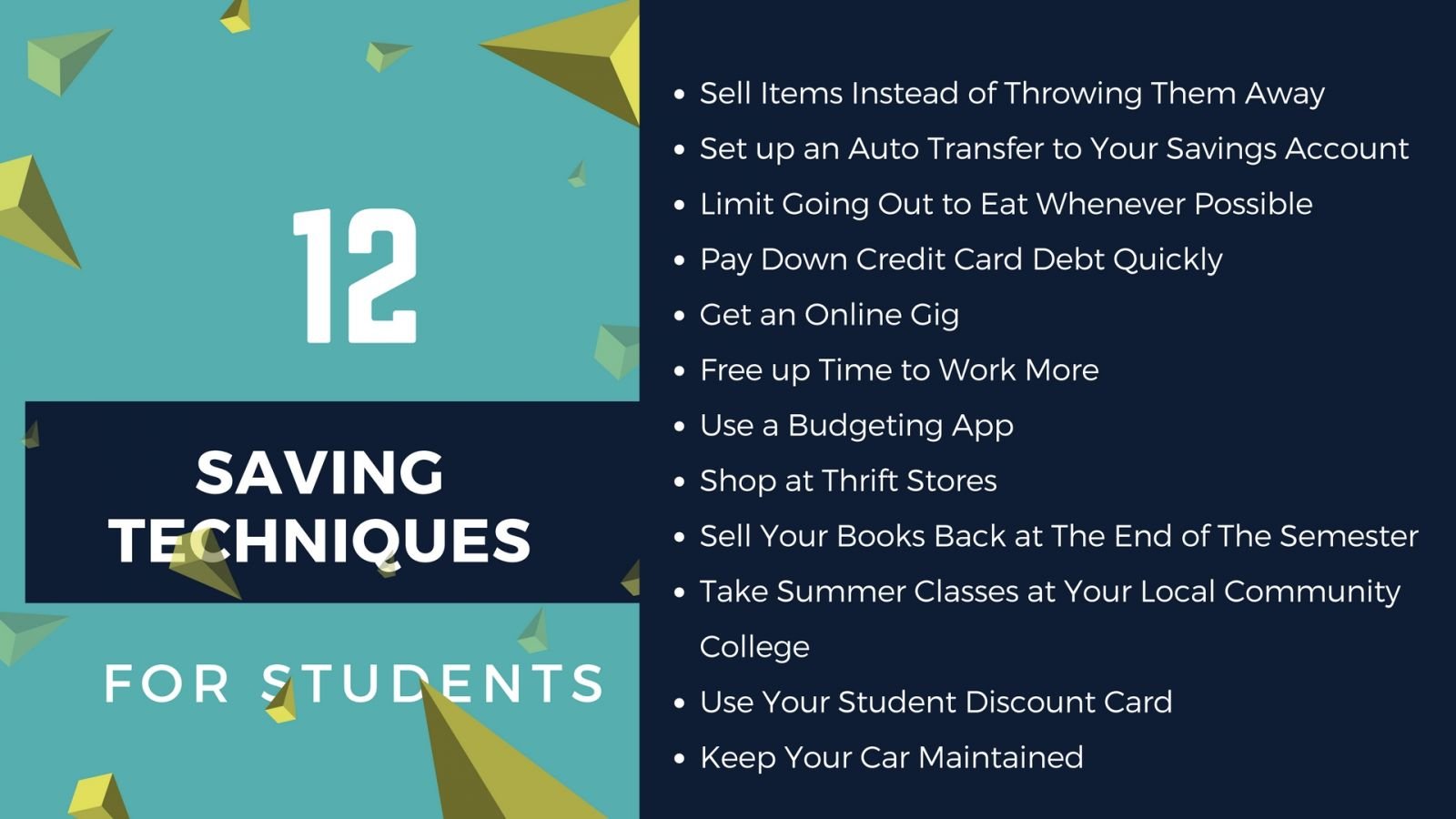

Saving Techniques For Students

Saving Techniques For Students

It’s sad to say, but money troubles are a common thing among college students. For one thing, it can be difficult to carry a course load and work enough hours to cover expenses, let alone recreational spending. In addition to that, the busy life of a college student often means additional expenses. For example, there is the cost of gas to travel home on the weekends if you live on campus. You might also find it difficult to cook your own meals if you live in a small dorm, or just don’t have the time.

If you are broke, you aren’t alone. Fortunately, there are ways for students to save more money and lower expenses. Check out these 12 saving techniques for students.

- Sell Items Instead of Throwing Them Away

Are you upgrading your wardrobe, purchasing a new gaming console, or replacing the tv in your dorm? Don’t trash your old stuff. Consignment shops, pawn shops, video gaming stores, and other places will often give you cash or store credit for these items.

- Set up an Auto Transfer to Your Savings Account

Chances are, your paycheck goes right into your checking account. To start accumulating savings, open a savings account at the same bank. Then, schedule a transfer to put money into savings every time you get paid.

- Limit Going Out to Eat Whenever Possible

It’s easy to develop a drive thru and coffee shop addiction as a college student. That can really add up. Even if you eat out once a day at cost of $5, that’s $150 a month. That’s easily a phone bill or a utility bill. Learn to cook if you have the facilities. Otherwise, pack a sandwich or something simple.

- Pay Down Credit Card Debt Quickly

Believe it or not, it can be a smart idea to get a credit card. If you are responsible, you will build a good credit score and establish your financial responsibility. Just be sure you don’t carry too much of a balance. Paying down credit card debt is a smart money move.

- Get an Online Gig

You can earn part-time income online if you have a computer. You can fill out surveys, complete small tasks through Mechanical Turk, even tutor online. These jobs aren’t lucrative by any means, but it’s pretty easy to earn enough money for a couple of recreational activities each month.

- Free up Time to Work More

Simply put, the more you earn, the more you save. Try juggling your schedule so that you can work one or two extra shifts each week. If you’re a graduate student working on their dissertation, you can free up a bit of time by getting some professional assistance. We have reviews of the best dissertation writing services for you to check out.

- Use a Budgeting App

To learn to save and reduce expenses, you first need to know where all your money is going. A good budgeting app will allow you to input your incoming and outgoing funds. Some can even interface directly with your checking account and credit cards.

- Shop at Thrift Stores

Thrift stores are no longer junky places with things that nobody wants. You can often find decently priced electronics, barely used clothing, even furniture and household items. If you need something for your apartment or dorm room, check out a thrift store before you pay full price.

- Sell Your Books Back at The End of The Semester

Take your old books back to the bookstore at the end of the semester. Even if you only get a fraction of what you paid, at least that’s something. Better yet, find a website where students buy and sell textbooks. You might get a better price.

- Take Summer Classes at Your Local Community College

Tuition at a four year college or university can be a bit high. Community college tuition is much less expensive. Speak to your advisor and ask if you can pick up some credits at your local CC during the summer. If they will transfer, to your chosen college or university, you can save a significant amount of money.

- Use Your Student Discount Card

One of the best saving techniques for money loving students is right in your wallet. Your student ID card can often be used as a discount card. You can save money on movies, going out to eat, dry cleaning, hotel stays, taxi fare, clothing, and other items. Sometimes, you can even save money on things you order online.

- Keep Your Car Maintained

This may seem like an expense, but the truth is keeping your car maintained will save you money in the long run. Keep your oil changed, check your tire pressure, and get any small issues fixed ASAP. You will save money on gas because your car operates efficiently. You’ll also avoid having to pay for expensive repairs that are the result of neglect.

Conclusion

These 12 saving techniques for students will keep more money in your pocket. You can use these extra funds to pay down debt, enjoy life, or even start a great savings account. Remember that it’s never too early to become a saver!

Our Advantages

Quality Work

Unlimited Revisions

Affordable Pricing

24/7 Support

Fast Delivery