How Artificial Intelligence Affects the Stock Market Essay

Abstract

Artificial Intelligence (AI) means the modern wide variety of computer applications that have notable machine learning capabilities hence depicting that of human intelligence. The stock market refers to trading platforms where buying and selling of shares can be undertaken by investors. By use of AI, there is a possibility to monitor the trading patterns and predict how markets can be shaped in the future. Many companies such as Kavout and Epoque have embraced the use of AI in their stock trading paraphernalia. Through artificial intelligence, companies have been advantaged to improve their returns on investment. There is a possibility that in the future, AI will empower stock markers further. For instance, due to the current rise of globalization, AI will take all the advanced patterns of cloud computing to give a better analysis of stock management models, investment processes, and fast data speed when it comes to buying and selling of shares.

Introduction

Artificial Intelligence (AI) is a wide-range category in computing that is effective in developing smart machines that can undertake tasks that may be human intelligence oriented (Patel et al., 2021). AI enables machines to think humanly, rationally, and act humanly and rationally too. Stock markets refer to where people and institutional investment firms come together to transact in shares in a given public venue. Today, buying and selling of shares exist as electronic marketplace places. Thus, it is important to report on how AI is responsible for enabling machines and equipment used in stock market paraphernalia. AI uses modern microservices architecture and can be subject to cloud software. This paper presents a report on how AI affects stock markets.

Artificial Intelligence Effects on Stock Market

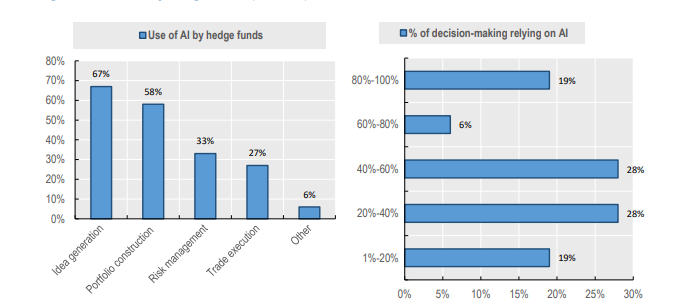

AI can be termed as one of the key components that will shape the future of stock trading. For instance, the use of robotic instruments to analyze a wide variety of data points and implement fine trades is evident as a result of AI (Sushma & Tarun, 2020). Therefore, the optimal price, the analysis predicts markets that have significant accuracy in stock mathematics. Similarly, by the use of AI-centric machines in stock trading, trading companies prevent the risk of giving higher returns. Many companies have embraced AI in trade execution by 27% and decision making, as seen in figure 1 below (Xie & Akiyama, 2021). Thus, as a result of globalization, AI has been able to penetrate the stock markets in all countries hence effective in stock markets.

Figure 1: Artificial intelligence usage in trade execution and decision making

Machine Learning as a Booster in the Subject

Machine learning is developing at a fast pace, and financial firms are not left behind in adopting the new applications. Antony Antenucci, the vice president of Intelenet Global Services supports the idea that the increased intelligence in cloud computing has advanced many sections of stock markets (Sharma & Kaushik, 2017). Antenucci explains that some companies, such as Wall Street realized they could increase their business functions through the use of AI. He says, “they could effectively crunch millions upon millions of data points in real-time and capture information that current statistical models couldn’t” (Patel et al., 2021). Therefore, it means that companies around the world can utilize the new trends to enable smarter trading patterns in the stock market and other fields.

Efficacy of Adopting Machine Learning Technology

By adopting the use of AI, stock markets have been made efficient in buying and selling shares. End-to-end machine learning under the umbrella of AI has given a chance to have quality and quantity data science that can be used in analysis during stock trading (Sharma & Kaushik, 2017). For example, AI information and expertise power have led to the formulation of investment strategies. That is possible by developing a smart asset allocation system using comprehensive learning to forecast the assets of a given portfolio within the stock market (Sushma & Tarun, 2020). Therefore, embracing artificial intelligence in stock trading ensures that stock trading businesses can have a concrete transactions that are supported by the latest trends in cloud computing.

Nowadays, proprietary investment technology can combine AI with an active exchange-traded fund (ETF). The above is possible by processing and accumulating data generated from various sources such as social media, news journals, and financial statement pages (Sushma & Tarun, 2020). Globally, comp

Our Advantages

Quality Work

Unlimited Revisions

Affordable Pricing

24/7 Support

Fast Delivery